The Growing Threat of Investment Scams in India: How to Protect Yourself

Investment scams are fraudulent schemes where scammers lure people by promising high returns with little or no risk. In India, these scams have been on the rise, targeting individuals through social media, fake websites, and unauthorized apps.

Let's understand what investment scams are and how India is tackling financial fraud.

An investment scam is a type of financial fraud where scammers promise to double your money by investing through certain apps or websites.

While India’s economy is growing, the rise in scams poses a significant risk to investors, especially those new to the market.

Introduction:

· Lets Understand what Investment Scams are and how India is tackling the Financial Frauds.

· Investment Scam is nothing but a Financial fraud where scammers will give the hope that they will help you double the money by investing in some apps or in some websites.

· while India’s economy is growing, the rise in scams poses a significant risk to investors, especially those new to the market.

What Are Investment Scams? Why has been in the news for the past a few months?

· * In simple words, to describe investment scams, we have to understand the background of this. Investment scams, the name itself tells about what kind of scam it is.

· * Scammers will reach out through social media apps, and they will give the hope that if you do this investment, then they will double the money.

· * In starting, scammers will give you a small task, like Google reviews, when you complete that task, they will give you a certain amount to gain the trust.

· * Then they will slowly manipulate you and they will tell you to download the trading app from the Play store and they will tell you to invest in that app so that it looks like a legit investment scheme.

· * Let’s understand the scammer's typical structure. Scammers often promise high returns with low risk, which sounds too good to be true.

· * They will add you to some WhatsApp group or in Telegram groups and they start the scam. They tell you to invest in this company and all, but in the backend we don't know that we’re getting scammed by them, because the app looks legit and the company also looks legit. Because they create the fake app and the fake company name, which is there in the stock market, and they do the scams with the name of that company.

· * Scammers will use the proxy bank accounts to scam the people. When you invest the money in the apps, you think that it is a legitimate bank account, but you don't know that you’re sending the money to a proxy account, which was created by the scammer.

· * When you try to withdraw the money from the app wallet, then you find that there is nothing in that app wallet. Then you will get a message and they will say that if you want to withdraw the amount, then you have to invest this much amount, then you will get the double amount to your bank account.

· * Then you will realize that you got scammed with the name of Investment.

· * This is how scammers are scamming the people with the name of Investment.

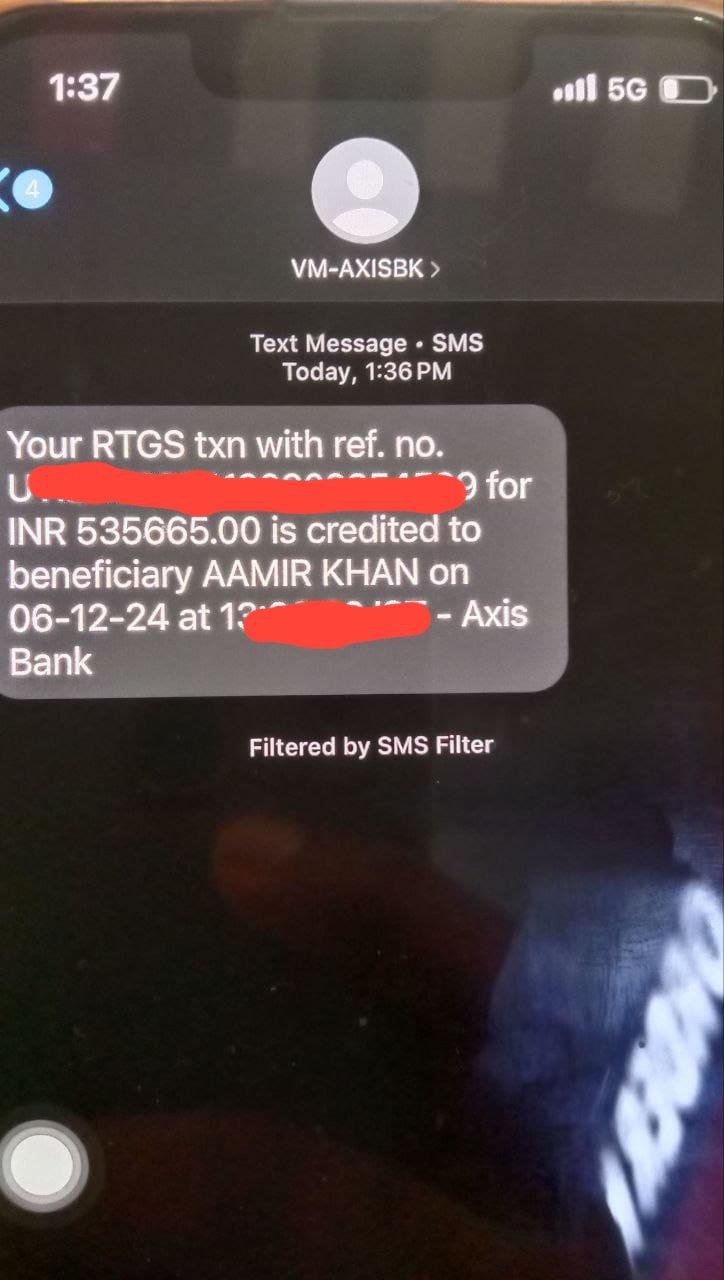

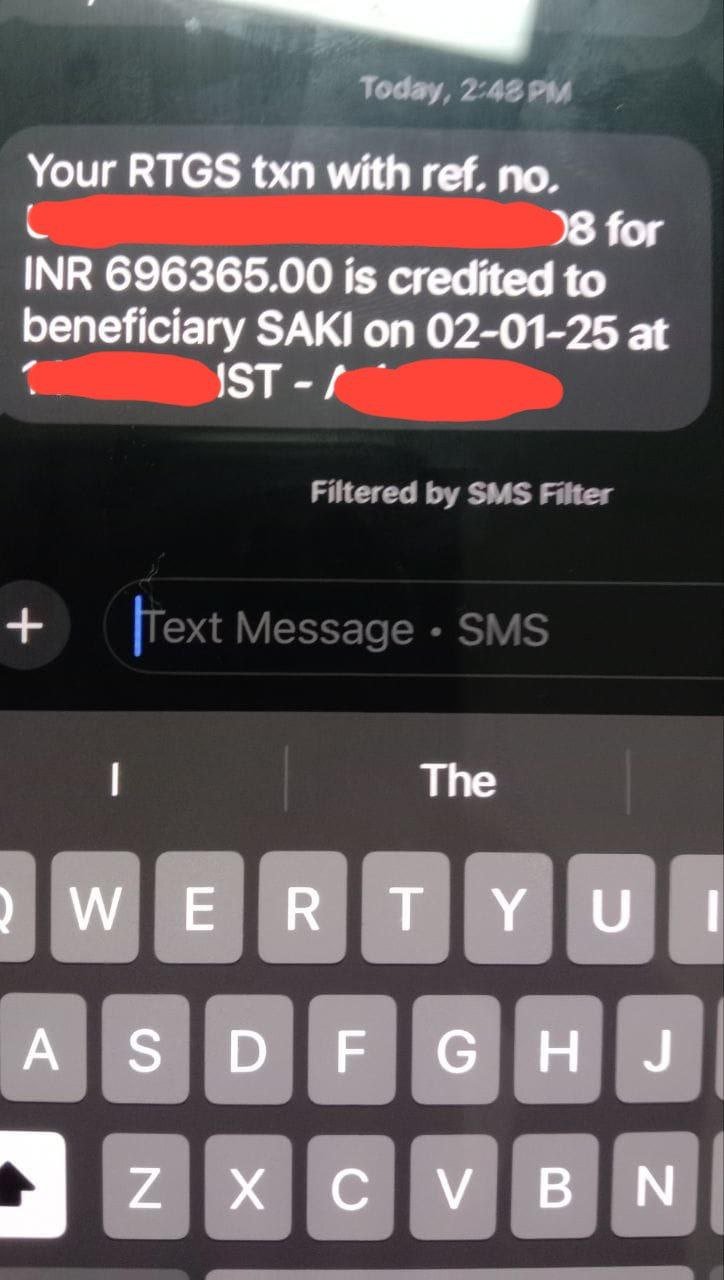

I want to share real-time experience where one of my friends got scammed around 21 Lakhs.

A few days ago, one of my friends contacted me and he said that Sulthan, my sister, got scammed in the name of an Investment in some stocks and all. Then I asked her Can you please elaborate. Then he said that my sister got a WhatsApp message and they said that we’re providing the Work From Home jobs, if you’re interested, let us know. As we all know, we the people of India like the shortest way to success in life, just like that, his sister also joined the group where they gave a task to his sister to give the Google reviews. When she did that task, she received 10,000/- to her account.

Then she thought that it was a legit work, then they told her to download the CoinDCX Bitcoin app, she downloaded the app, and she started to do the tasks. In this way she lost around 21 lakhs in this investment scam. She went to the Cyber cell to raise the complaint, when the Cyber Police tried to check the bank accounts where she transferred money to the scammers, then they found out that the scammers used proxy bank accounts. His sister transferred 6 lakhs, an amount that was transferred to the bank. Like this she transferred 21 lakhs to the scammer. When Cyber Police officers tried to check the bank details, they got to know that the accounts were nil, there was no money in those accounts. This is how scammers will scam the people with the name of Free and easy money.

Doctor Duped of ₹15.50 lakh via fake trading app.

Coimbatore doctor lost ₹15.50 lakh to a fake trading app scam via a YouTube link and Whatsapp group "49 Upstocks Wealth Group". Police filed a case under Bharatiya Nyaya Sanhita and IT Act.

Red Flags to Watch Out For:

· Unrealistic Promises: High returns with minimal risk or guaranteed profits.

· Lack of Transparency: The absence of clear details about the investment.

· Pressure to Invest Quickly: Scammers often create a sense of urgency to get people to invest without proper due diligence.

· Unlicensed Entities: Investment platforms or brokers that are not registered with SEBI or other financial authorities.

· Untraceable Operations: If the investment opportunity is not traceable or doesn't have a valid address/contact details, it’s a red flag.

How Scammers Exploit Investors:

· Emotional Manipulation: Scammers often target individuals in financial distress, promising a way out of their problems.

· Technology and Social Media: Use of social media platforms, fake websites, fake apps, and advertisements to make scams look legitimate.

· Lack of Financial Literacy: Many investors, especially in rural areas or those who are new to investing, fall for scams because they don’t understand the basics of investing. Scammers are using Cyber Psychology to manipulate the minds of the people with the promise of easy money.

“According to the Sreebala ma’am, the Deputy Commissioner of Police, Cyber Crimes, Hyderabad. Most of the Investment scams are done by IT Professionals only.”

I know most of the people who are reading this blog will doubt how the scammers get our details and all?

· · Most of the time we whenever we go to malls or when ever we go to petrol pumps there you will find some people will reach you out and they will say that you will get some gifts or rewards or coupons for trips if you fill the forms and most of use share the personal information like Name, contact number, address and Gmail id and we wil submit them.

· · From there, only scammers will collect our personal information, and they try to scam the people by pretending to be a Company HR/ Share Market company investors, etc….

· · Whenever we share our info in public places like in scratch cards, etc, then you have to fix that your data is in the public domain, as simple as that. Anyone can get your data by paying a certain amount to those people who are selling the personal Information to the scammers.

How to Protect Yourself from Investment Scams:

· Do Your Research:

- Always check the legitimacy of the platform or company you are investing in. Verify its credentials with SEBI or other trusted financial authorities.

- Cross-check reviews and testimonials to see if they are from credible sources.

· Consult with a Financial Advisor:

- Before making significant investment decisions, seek advice from a certified financial advisor to ensure you're making informed choices.

· Avoid Pressure Tactics:

- Scammers often use high-pressure sales tactics. Take your time to make investment decisions and never act on impulse.

· Diversify Your Investments:

- Spread your investments across different assets (stocks, bonds, real estate, etc.) rather than putting all your money in one place.

· Don’t share your personal information in public places like Malls, Petrol pumps in the name of scratch cards or the name of coupons and gifts.

· Don’t download any kind of APK files on your device if anyone tells you to download to invest the amount. Always be vigilant and be alert.

What to Do if You Fall Victim to an Investment Scam :

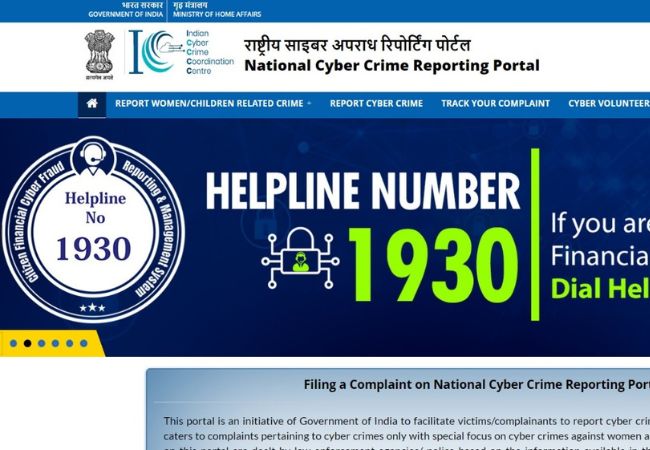

· Report Suspected Scams:

- If you suspect a scam, report it to SEBI, the Cyber crime Police Station or dial 1930 to raise a complaint against the Financial Frauds, or any other regulatory authority. Prompt reporting can save others from falling into the trap.

· Role of Cyber Crime Cells :

· Cyber crime cells in tackling online investment scams.

· If you have already lost money due to financial fraud or are a victim of Cyber crime, please report at the Cyber Crime Helpline Number 1930 and raise a complaint. If 1930 didn’t receive the call, then try to reach out to the nearby Cyber Cell and file a complaint. Try to raise a complaint within 4 hours of the time when the crime is happening, that is known as “Golden Hour”. When you try to raise a complaint in the Golden Hour, then the LEAs will try to freeze the scammer's bank account so that your money is scammed, it won't come outside. When LEAs freeze the scammer bank account, then he can't withdraw, or he can't change the amount into cryptocurrency. It will be easy for the LEAs to track the scammer.

- Reiterate the importance of staying informed and being cautious when investing.

- Emphasize that while scams are on the rise, awareness and vigilance can greatly reduce the risk of falling victim.

- End with a call to action, urging readers to educate themselves and share their knowledge to protect others.

· We are in Cyber World, and each and everyone should be aware of ongoing Cyber Crimes and we have to spread awareness regarding Cyber Crimes to our friends and family members so that they also get to know about scams that are going on in this present world.

What's Your Reaction?